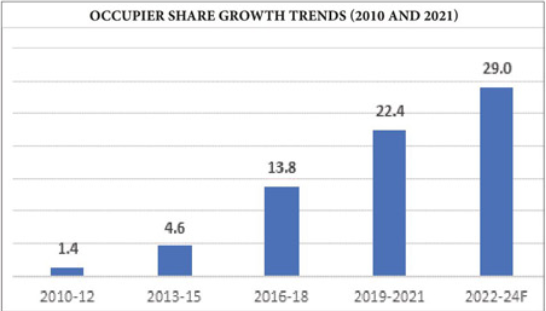

Startups have emerged as the fastest growing occupier group with 10% share in the office space. And as they continue to gain momentum, they are set to lease 29 msf of space during 2022-24 and their share of office space may well go up to13% in 2024.

The startups, according to Colliers-CRE Matrix Report, will register 1.3 times higher office leasing between 2022-24, compared to 2019-2021 period. The demand will be led by fintech and logistics startups as they have gained momentum post pandemic due to increased digital adoption and e-commerce boom, and hold a healthy pipeline in potential unicorns list. Additionally, increased digital adoption, availability of a deep talent pool, favourable government policies and funding options from venture capitalists are steering growth of startups.

Leasing by Startups in mn sq ft

Startups are the fastest growing occupier group currently accounting for 10% of the office space. This has created numerous opportunities for office space providers to rethink and reposition their workplace offerings to attract diverse set of occupiers. About 30 mn sq ft office space in India is occupied by co-working or flex players, with startups having a large share. Therefore, anecdotally, start-ups currently occupy more than 49.7 mn sq ft. The start-ups occupancy is expected to be about 78 mn sq ft of office space + 20-22 mn sq ft in flex spaces by 2024, totaling to about 100 mn sq ft by 2024. Within this start-ups segment, the Fintech niche aces all others as the leader in terms of number of start-ups, occupied office spaces and growth. Other sectors such as Ed-tech, Logistics, Healthtech, Proptech are expected to catch-up soon.

Occupier Share Growth Trends (2010 and 2021)

Bengaluru remains the top startup hub with a 34% leasing share during 2019-21, with Koramangala, HSR and Indiranagar being the preferred locations for startups. A well-developed ecosystem, deep technology talent, and a culture of entrepreneurship are major factors attracting startups here.

Delhi-NCR is amongst the fastest-growing market in terms of leasing by startups. Delhi-NCR witnessed a three-fold increase in leasing by startups during 2021 on a YoY basis. The region benefits from being a catchment for education institutions in the North and East India, and strong infrastructure. Mumbai has seen certain pockets of startup activity over the years. However, relatively higher rentals, and high cost of living are often seen as deterrents by early-stage companies. While metro cities remain the core hubs for startups, non-metro cities are seeing growth in startup leasing as well as flex space take up due to low cost of living, reduced CAPEX and work from anywhere trend. Emerging hubs such as Jaipur, Ahmedabad, Indore, Coimbatore are likely to witness rise in flex space and startup occupancy as entrepreneurs are increasingly leveraging these locations to launch operations.

As startups focus on creating collaborative culture, demand for well designed, fully managed spaces will increase. Flexible lease terms, minimal lock-ins and security deposits will also be an important parameter for startups while leasing space. This will create ample opportunities for flex space providers in metro and non-metro cities. Affordable locations close to city centres with expansion options are likely to be preferred by startups