While the expansion of data centre activity into growth markets across the APAC region remains on a strong footing, Indian cities of Hyderabad, Delhi and Chennai have emerged as prime markets with significant growth.

According to Knight Frank Data Centre Q3 2022 report, in partnership with a leading data centre research and analytics platform – DC Byte, Hyderabad, Chennai and New Delhi have emerged as one of the top Data centre markets in the Asia-Pacific region. The report focuses on nine rapidly emerging markets in Asia Pacific Region, namely- Osaka, Melbourne, Jakarta, Manila, Hanoi, Taipei, Hyderabad, New Delhi, and Chennai. Total IT Power (live, under construction and committed capacity) of Data Centre in the APAC region grew from just under 700MW five years ago, to over 3,000MW currently. Similarly, Indian cities of Hyderabad, New Delhi and Chennai hold almost 1,100MW of total IT Power, over 100MW of which is live capacity as on Q3 2022. The three Indian markets together, are expected to witness an additional 453 MW of IT Power which is currently in early stages of planning. About two-thirds of this supply was added in the past couple of years, effectively tripling estimated market capacity during this period. Close to 50% of this total supply is committed to or in early stages of planning.

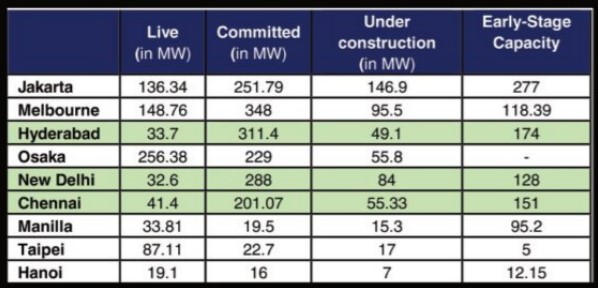

DATA CENTRE CAPACITY IN APAC REGION AS OF Q3 2022

Source: Knight Frank Research

In India, Hyderabad, New Delhi and Chennai together hold more than 100MW of live capacity (operational) in Q3 2022. Nearly 189 MW of data centre capacity is already under construction which will effectively triple live capacity in the near future. As much as 1.25 GW of IT Power is in the planning stage (committed and early-stage) of which over 800MW is already committed.

On the aspect of Live, Under-construction and planned (committed and early-stage) Data Centre capacity, Chennai holds the highest 41.4 MW of live capacity, followed by Hyderabad with 33.7MW and New Delhi with 32.6 MW as on Q3 2022. While current live capacity is highest in Chennai, it could soon be overtaken by New Delhi where under construction IT supply of 84MW would almost quadruple its live capacity to 117MW. With the highest planned (committed and early-stage) IT Power supply among the Indian markets of 485 MW, Hyderabad will continue to be a major Data Center market. Delhi and Chennai have a planned pipeline of 416MW and 352MW respectively.

Fuelled by strong market fundamentals and an increasing trend towards greater localisation of data centre facilities, total supply in these locations witnessed a significant increase over the last few years. According to Shishir Baijal, Chairman and Managing Director at Knight Frank India In India, the data centre industry has been on a high growth trajectory, partly driven by government policies, including easier access to credit and other incentives to boost data centre investment. As a result, cities like Hyderabad, New Delhi and Chennai are registering significant data centre market growth with almost two-thirds of existing capacities being added in just the last two years. Overall, the expansion of data centre activity into growth markets across the APAC region remains on a strong footing, reflecting the continued resilience of demand across each geography.