High cost of land, rising property prices, high-interest rates, deficient support infrastructure, and non-use of modern low-cost construction techniques, have all contributed to continuous decline in the share of affordable housing – both sales and new launches.

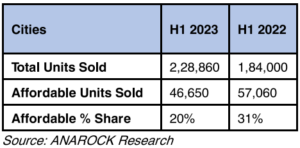

While the Indian luxury homes segment is firing on all cylinders, affordable housing continues to languish, with both supply and demand for housing getting shrunk, according to a latest Anarock report, the total sales share of this erstwhile poster-boy segment is down to approximately 20% in H1 2023, against 31% in the corresponding period in 2022. Of nearly 2.29 lakh units sold across the top 7 cities in H1 2023, just 20% or approximately 46,650 units were affordable homes. Back in H1 2022, of approximately 1.84 lakh units sold, over 31% or about 57,060 units were in the affordable category.

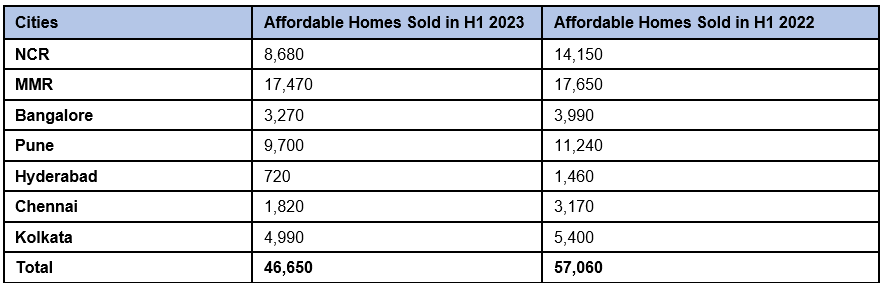

Among the top 7 cities, MMR and Pune saw the maximum affordable housing sales with 37% (approx. 17,470 units) and 21% (approx. 9,700 units) shares, respectively. NCR was close behind with approximately 8,680 affordable homes sold in H1 2023, comprising a 19% share of all affordable homes sold in the top 7 cities in H1 2023.

At approximately 720 units, Hyderabad saw the least number of affordable homes sold in H1 2023 – a minuscule 2% share of the total affordable housing sales in the top 7 cities.

Source: ANAROCK Research

Source: ANAROCK Research

“It isn’t just that the pandemic derailed the growth of this once highly-hyped segment – other factors posed challenges to both buyers and developers of this category,” says Anuj Puri, Chairman Anarock. “For instance, with land deals soaring across the country, the cost of this basic input for all real estate has spiralled in tandem. It is becoming increasingly unviable for developers to buy land at higher prices to build low-margin mass housing. Other input costs have also gone up significantly in the last few years. Launching affordable housing projects has become singularly unattractive, especially since the monetization potential of low-budget homes has also reduced due to shrinking demand for them.”

Lack of sound support infrastructure in the distant suburbs and the conspicuous absence of contemporary low-cost construction techniques are additional challenges for this segment.

As for affordable housing buyers, a majority are seen postponing purchase decisions due to rising real estate prices over the last one year. The lower demand also reflects in the new supply of affordable housing as developers have turned their focus on mid-range, premium and luxury projects which are in significantly higher demand.

Affordable Housing – New Supply Dynamics

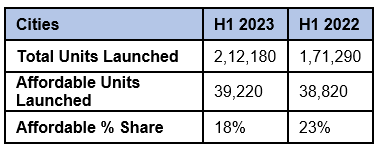

Anarock research data indicates that the total new supply share in the affordable category across the top 7 cities has declined from 23% in H1 2022 to 18% in H1 2023.

Of approximately 2,12,180 units launched in H1 2023, just 39,220 were in the affordable housing category. In H1 2022, of about 1,71,290 units launched, nearly. 38,820 were in this category.

Source: ANAROCK Research

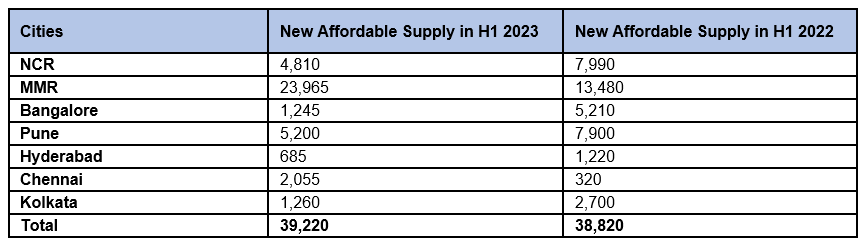

In terms of new supply across the top 7 cities, MMR, Pune and NCR saw the maximum new affordable housing supply in H1 2023, collectively accounting for 87% of all affordable supply share.

Source: ANAROCK Research

MMR saw new affordable housing supply of approx. 23,965 units in H1 2023, against 13,480 units in H1 2022 – a 78% increase in the period.

Pune saw approx. 5,200 new affordable units launched in H1 2023, down by 34% from approx. 7,990 units launched in the year ago period.

NCR saw its new affordable housing supply drop by 40% in the period – from approx. 7,990 units in H1 2022 to approx. 4,810 units in H1 2023.