With mid-segment, premium and luxury housing in high demand, housing sales across top cities are seeing high sales.

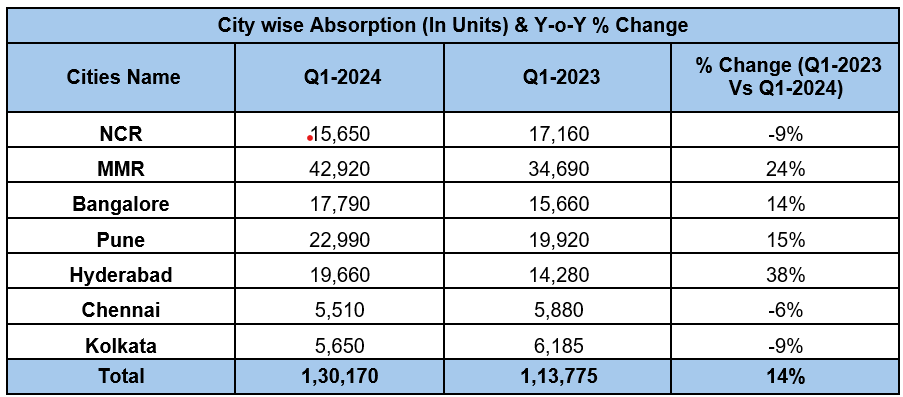

The bull run in the Indian housing market continued in the first quarter of the year. Quarterly housing sales are at an all-time decadal high with nearly 1,30,170 units sold in Q1 2024 across the top 7 cities, reveals the latest Anarock data. This is a 14 percent yearly rise against approximately 1,13,775 units sold back in Q1 2023.

MMR and Pune accounted for over 51 percent of the total sales in the top 7 cities, with MMR recording a 24 percent yearly jump and Pune witnessing an over 15 percent yearly rise. New launches across the top 7 cities continued above the one lakh mark but witnessed a mere 1 percent yearly rise – from 1,09,570 units in Q1 2023 to over 1,10,865 units in Q1 2024.

Notably, MMR and Hyderabad saw the maximum new supply, accounting for 51 percent of the total new launches across the top 7 cities. Hyderabad saw a 57 percent yearly increase in new supply in Q1 2024, while MMR saw its new supply decline by 9 percent in the period. The quarter has recorded the highest ever sales in the last decade amid a significant rise in demand for high-ticket priced homes priced INR 1.5 Cr and above., according to Anuj Puri, Chairman, Anarock.

Despite new launches remaining above the 1 lakh mark in this quarter, available inventory in the top 7 cities dropped by 7 percent annually – from approx. 6,26,750 units by Q1 2023-end to approx. 5,80,890 units by Q1 2024-end. Among the top cities, NCR saw highest decline of 27 percent in its unsold stock in Q1 2024. NCR’s unsold stock is currently lower than in other prominent cities like MMR, Pune, and Hyderabad.

India’s overall economic scenario remains positive, with the country’s GDP growth rate pegged as the highest globally, and inflation also seems to be under control. This outlook supports enduring homebuyer sentiment.

New Launch Overview

The top 7 cities recorded new launches of around 1,10,865 units in Q1 2024 against 1,09,570 units in Q1 2023, increasing by just 1 percent over the previous year’s corresponding period. The key cities contributing to new launches in Q1 2024 were MMR (Mumbai Metropolitan Region), Hyderabad, Pune, and Bengaluru, which together accounted for 83 percent of the quarter’s supply addition.

- MMR saw approx. 33,800 units launched in Q1 2024 – a decline of approx. 9 percent over Q1 2023. More than 59 percent of the new supply was added in the sub-INR 80 lakh budget segment.

- Hyderabad added approx. 22,960 units in Q1 2024 – a yearly jump of 57 percent over the corresponding period last year. Over 33 percent of the new supply was added in the high-ticket – above INR 1.5 Cr price segment.

- Pune added approximately 18,770 new units in Q1 2024 compared to 19,420 units in Q1 2023 – a decrease of 3 percent.

- Bengaluru added approx. 16,485 units in Q1 2024 – a yearly increase of 22 percent. Approximately 66 percent of the new supply was in the mid-range and premium segments (INR 40 lakh – INR 1.5 Cr.)

- NCR saw new supply dip by over 42 percent against Q1 2023, with approximately 7,270 units launched in Q1 2024 against 12,450 units in Q1 2023. Notably, 55 percent of the new supply was added in the ultra-luxury segment (homes priced above INR 2.5 Cr.)

- Chennai added approximately 7,290 units in Q1 2024, a yearly increase of 14 percent over Q1 2023. At least 87 percent of the new supply was in the mid and premium segments (priced within INR 40 lakh to INR 1.5 Cr)

- Kolkata added approx. 4,290 units in Q1 2024, a decline of 27 percent over Q1 2023. Approximately 90 percent of the new supply was in the affordable and mid segments (priced up to INR 80 lakh.)

- Bengaluru saw housing sales increase by 14 percent in Q1 2024 against Q1 2023, with approx. 17,790 units sold in Q1 2024 and approx. 15,660 units sold back in the same period last year

Source: ANAROCK Research

Overall Sales Overview

About 1,30,170 units were sold in Q1 2024 – an increase of 14 percent over Q1 2023. NCR, MMR, Bengaluru, Pune, and Hyderabad together accounted for 91 percent sales in the quarter.

- MMR saw the highest housing sales of approx. 42,920 units in Q1 2024, increasing by 24 percent over Q1 2023. Approx. 34,690 units were sold in Q1 2023

- Pune saw approx. 22,990 units sold in Q1 2024, increasing by 15 percent over Q1 2023 when approx. 19,920 units were sold

- Hyderabad recorded the sale of approx. 19,660 units in Q1 2024, a 38 percent increase over Q1 2023 when approx. 14,280 units were sold

- NCR saw a 9 percent decline in housing sales – from approx. 17,160 units in Q1 2023 to approx. 15,650 units in Q1 2024.

- Kolkata also saw a decline of 9 percent in housing sales in the period – from approx. 6,185 units in Q1 2023 to approx. 5,650 units in Q1 2024.

- Bengaluru saw housing sales increase by 14 percent in Q1 2024 against Q1 2023, with approx. 17,790 units sold in Q1 2024 and approx. 15,660 units sold back in the same period last year.

- Chennai saw approx. 5,510 units sold in Q1 2024 – a decline of 6 percent over Q1 2023, at least partially attributable to factors like the introduction of Tamil Nadu government’s three-tier guideline values for apartment complexes in late 2023, and high stamp duty and registration charges.

Source: ANAROCK Research

Price Movement & Current Inventory

Average residential property prices across the top 7 cities have seen a significant jump in the last one year – ranging between 10-32 percent in Q1 2024 when compared to Q1 2023, mainly due to an increase in the prices of construction raw materials and the overall rise in demand. Hyderabad and Bengaluru recorded the highest annual price jump of over 32 percent and 25 percent, respectively.

Despite massive new supply added to the top 7 cities in Q1 2024, overall available inventory declined by 7 percent in Q1 2024 when compared to Q1 2023. The total available inventory in the top 7 cities as of Q1 2024-end stands at approx. 5.81 lakh units. At 27 percent, NCR witnessed the highest reduction in available inventory in Q1 2024 when compared to Q1 2023.