The new year has started on a promising note for the Mumbai realty with property registrations touching the highest numbers in 12 years. Residential realty constitutes a major share with 80 percent registrations and 58 percent of registered properties in January 2024 were worth Rs 1 crore and above.

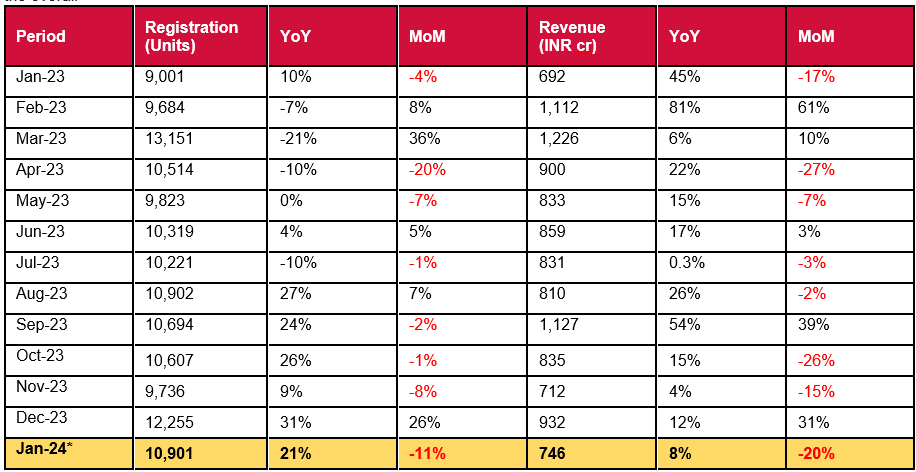

Mumbai city (area under BMC jurisdiction) in January 2024 is to witness registration of 10,901 properties, contributing to a revenue of Rs 746 crores for the state government. This highlights a notable 21% Year-on-Year (YoY) increase in registration numbers and a 8% YoY growth in revenue compared to the previous year. Homebuyer confidence in the Mumbai market persists and the outlook remains positive. This positive outlook has led to a substantial upswing in property registrations in Mumbai. Of the overall registered properties, residential units constitute 80%, the remaining 20% constitute non-residential assets.

Mumbai Property Sale Registrations and Revenue

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India, *Numbers projected based on per day run rate

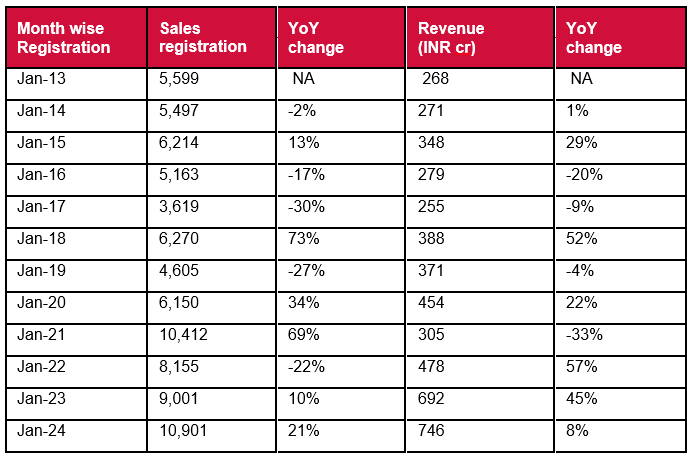

Best January Sale Registrations in Last 12-years (2013-2024)

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India

In January 2024, Mumbai witnessed its highest number of property registrations occurring in January month in a 12-year span. The previous peak was fuelled by a surging optimism and a spillover of pent-up demand as the effects of the pandemic gradually diminished. However, the recent increase can be attributed to rising income levels and a favourable perception towards homeownership. Concurrently, the city also recorded best January tally in terms of revenue collections in 12-years, primarily propelled by higher stamp duty rates, burgeoning property prices, and an increased share of premium properties.

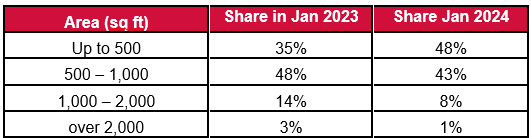

Apartment Area wise Sales

In January 2024, there was an increase in the share of apartments measuring 500 sq. ft. and below, rising to 48%, as opposed to the 35% recorded in the previous year. Conversely, the share of apartments ranging from 500 sq. ft. to 1000 sq. ft. witnessed a decline, decreasing to 43% from the 48% reported during the same period last year. Nevertheless, this appears to be an isolated occurrence, as the predominant inclination of people has generally been towards larger apartments.

Area-wise Breakup of Apartment Sales

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

Of the total properties registered, Central and Western suburbs together constituted over 75% as these locations are a hotbed for new launches, offering a wide range of modern amenities and good connectivity. 86% of Western suburb consumers and 85% of Central suburb consumers opt to purchase property within their micro market. This choice is influenced by the familiarity of the location, along with the availability of products that align with their pricing and feature preferences.

According to Shishir Baijal, Chairman and Managing Director, Knight Frank India, the sustained strength in the premium segment, marked by a significant surge to 58% in January sales share, underscores the market’s resilience and attractiveness. “The positive trajectory is poised to continue, especially with the anticipated strong economic momentum and potential easing of interest rates throughout the year, fostering a conducive environment for homebuyers. The support of both the central and state governments including the budget is crucial in sustaining this positive momentum to propel the real estate sector”

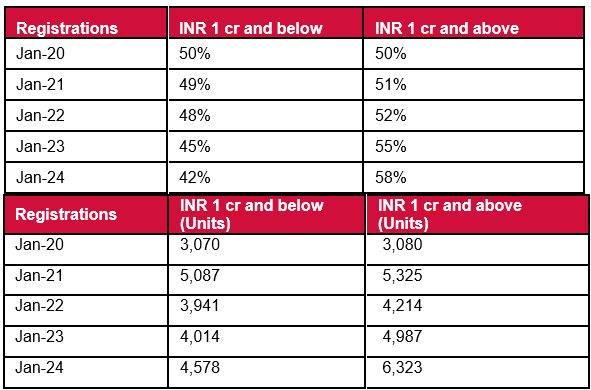

Ticket Size-wise Property Sale Registrations

Over the past few years, there has been a steady increase in the percentage of property registrations valued at Rs 1 crore or higher. This percentage has climbed from 55% in January 2020 to around 58% in January 2024.

The surge in property prices, coupled with a 250-basis point increase in the policy repo rate over the last two years, has negatively affected the segment priced below the INR 1 crore threshold. However, properties valued at 1 crore and above have demonstrated a relatively smaller impact from these headwinds.