Despite a slow start in the first quarter, office leasing has made a strong comeback in the second quarter and promises to register a healthy growth this year.

India office sector is expected to close stronger at 40-45 million sq feet of gross leasing across the top 6 markets of Delhi-NCR, Mumbai, Pune, Chennai, Bengaluru, Hyderabad in 2023, perceptibly higher than predicted in March 2023, according to Colliers’ latest report “India Office Market – Changing Winds.” Domestic office demand is holding up well, supported by resilient economic outlook in spite of the drag from weak external demand. At the global level, the economic forecast for 2023 is modestly higher than predicted in April 2023, pulled by marginal improvements in the US, UK and Europe. This gradual but definite recovery surely fastens up the levers to revive external sectoral demand, thereby impacting India office demand.

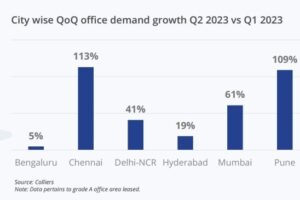

The year started on a cautious note registering 10.1 million sq feet of gross absorption in the first quarter, and then saw a relatively faster recovery in the second quarter. The Q2 registered 14.6 million sq feet of leasing activity, a growth of around 50% QoQ. In fact, improvement in business sentiments across varied demand segments and a visible uptick in the domestic economy translated into this growth in leasing activity.

Grade A gross absorption (in million sq feet)

Source: Colliers

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed.

Most of the major economies, driven by abatement of pain points are envisaged to perform better in the near-mid term. IMF has made upward revisions in 2023 GDP forecasts for most of the prominent economies during July 2023, compared to its April estimates. With India, USA and Europe and UK being major sources of business, a positive change in their economic outlook is likely to have a perceptible positive impact on India’s office market outlook for 2023 & beyond.

“Macro-economic indicators have been displaying consistent positive signals. While repo rates have probably entered a stable phase, GST collections, manufacturing & service indices and equity markets in general have been reflecting strong undercurrents of accelerated momentum. The momentum is likely to continue in the second half of the year and ultimately result in better than anticipated office market performance in 2023. Q2 2023 has already set the tone for a stronger 2023, and the year is expected to witness 40-45 million sq feet of gross leasing across the top 6 cities.” says Peush Jain, Managing Director, Office services, India, Colliers.

Amid the evolving dynamics of the office real estate market, it is evident that tech occupiers, primarily rooted in the US, EU, and UK, have a significant bearing on office space leasing in India. Concurrently, a notable surge in demand has been observed among domestic occupiers, particularly those in the engineering and manufacturing sectors, during the first half of 2023. In fact, 2021 onwards the demand from domestic occupiers has surged significantly compared to the global occupiers.

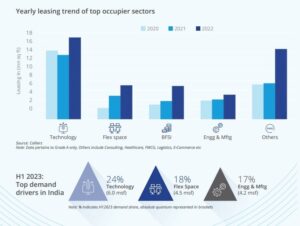

During H1 2023, technology sector led the office space demand at 24% share, followed by flex space and engineering & manufacturing sectors at 18% & 17% respectively. The pattern of demand drivers underscore the growing prominence of these sectors, which have displayed a consistent uptick in demand since 2020.

“Sectors such as Technology & BFSI have seen over 50% QoQ growth during Q2 2023 while demand from engineering & manufacturing has surged two-fold over the preceding quarter. The services and manufacturing PMIs also registered significant peaks in 2023, indicating healthy growth of these critical demand sectors going forward. As the occupier confidence improves further, leasing momentum across pivotal sectors is likely to continue in the second half of the year.” says Vimal Nadar, Senior Director and Head of Research, Colliers India.

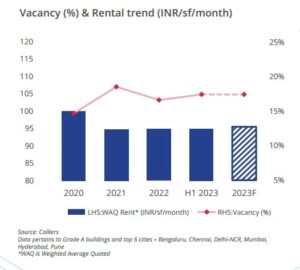

The optimism observed in the demand side is mirrored by a palpable positive shift in the supply side. Indian developers are showing a heightened sense of confidence, buoyed by improved market sentiments. H1 2023 saw 22 million sq feet of new supply across top 6 cities, registering a 31% rise during Q2 2023 compared to first quarter. Looking ahead, a growth of 10-20% in supply in H2 2023 compared to H2 2022, is anticipated. This growth trajectory is indicative of the developers’ responsiveness to the changing market dynamics and increasing demand for quality office spaces. 2023 is likely to see robust supply aligned with the anticipated space uptake across major office markets, vacancy levels to be rangebound leading to a potential rental upside.