Registering a four-fold rise over the last five years, flex space has fuelled Pune’s office real estate, with technology sector being a major driver.

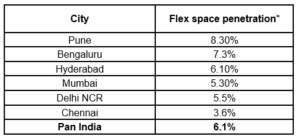

Driven by healthy investment and robust demand from technology & other mainstream sectors, Pune’s flex space stock is expected to cross 8 million sq feet by 2025, accounting for 10% of the total office stock of the city, according to Colliers’ latest report ‘Pune – Tech-tonic shift to flex’. Pune’s flex space market has seen significant growth during the last five years, led by a burgeoning young population, presence of large tech corporates, and proliferation of numerous startups. Occupiers’ hybrid workstyles have further accelerated the demand for flex spaces in the city, especially post pandemic. Since 2018, Pune’s flex stock has witnessed a 400% rise and currently stands at 5.4 million sq feet as of June 2023. This translates to 8.3% of the total Grade A office space of the city, the highest across the top 6 cities. While Bengaluru remains the largest flex space market pan India in terms of size of flex stock, Pune has surpassed Bengaluru in flex space penetration, at 8.3%.

City-wise flex space penetration as of Q2 2023 (%)

Source: Colliers

Note: Data pertains to Grade A buildings

*Flex space penetration pertains to the share of flex stock in total Grade A office stock of the city

Flex spaces have been at the forefront in enabling new workspace models such as Flex + Core, distributed workplace strategy and hybrid working for occupiers, and have become an integral part of occupiers’ portfolio. At an all-India level, share of flex space in occupiers’ portfolio has risen, from 5-8% in 2019, to 10-12% in 2023.

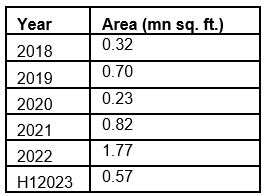

To meet the burgeoning demand from occupiers, top operators in the city have expanded rapidly over the last five years, with annual space uptake rising multi-fold each year. During 2022, flex space operators leased 1.77 million sq feet of office space, accounting for 35% of the total leasing of the city. The first half of 2023 also witnessed robust leasing by the flex space operators at 0.57 million sq feet, about 22% of the total leasing. As a result, flex space stock also witnessed a significant 4X rise, from 1.3 million sq feet in 2018, to 5.4 million sq feet as of June 2023.

Leasing by flex space operators in Pune (mn sq ft)

Source: Colliers

Note: Data pertains to Grade A buildings

Pune has emerged as one of the popular top flex space destinations pan India, registering a significant growth in the last 5 years. The share of Pune in pan India flex leasing has increased manifold from 5% in 2018 to 25% in 2022. Flex spaces in the city are also seeing increased occupancy levels, as enterprise outsourcing has become mainstream. As flexibility, scalability, and cost optimization remain ‘table stakes for occupters office expansion strategies, flex spaces will continue to gain prominence in the city. A greater focus on flight to quality, increased customization and amenitization would further provide a business case for a rental upside.” Says Animesh Tripathi, Managing Director Pune, Colliers India.

As majority of technology occupiers have adopted ‘hybrid work model’ as a long-term strategy, flex spaces have become an integral part of tech occupiers’ real estate portfolio. Technology sector remained the top occupier of flex space, and contributed to 43% of the total seat uptake during 2020-H1 2023, followed by engineering & manufacturing at 27% share. As hybrid working is expected to remain a mainstay for technology occupiers, they will continue to lead flex space demand in the city.

“Flex spaces have seen remarkable growth in Pune in the last 5 years with its share in the city’s office stock growing from 2.8% in 2018, to 8.3% as of June 2023. Led by rising demand from technology and engineering & manufacturing sectors, flex space operators are rapidly expanding their footprints in the city. While smaller operators continue to foray into the space, market continues to remain consolidated with the top 5 operators holding a little more than three-fourth share. Amidst an evolving business environment, occupiers will continue to commit towards Grade A operators seeking more scalability options across locations with increased customization. “according to Vimal Nadar, Senior Director & Head of Research, Colliers India.

Pune’s Baner-Balewadi and CBD are amongst the top 10 flex micro-markets pan India amongst ORR & SBD 1 (Koramangala, CV Raman Nagar, IRR, Indiranagar, and others) in Bengaluru and SBD (Madhapur, HITEC City, Kondapur and Rai Durg) in Hyderabad. As of Q2 2023, Baner-Balewadi accounted for 44% of Pune’s total flex stock followed by CBD at 31%. Kalyani Nagar, Mundhwa and Yerwada are some of the popular flex locations within CBD. Going forward, Viman Nagar and Kharadi also hold significant potential for flex space expansion in next the 2-3 years due to robust supply pipeline, well-established infrastructure, and the upcoming metro connectivity in the region.