The Indian economy’s bounce back amid high inflation in developed markets has led stakeholders to remain confident about the domestic economic climate and the real estate sector’s performance for the next six months. This has positively influenced stakeholder sentiments in Q2 2023.

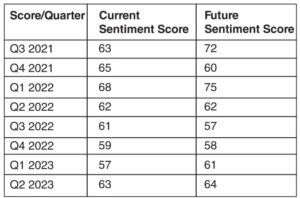

The 37th edition of the Knight Frank-NAREDCO Real Estate Sentiment Index Q2 2023 (April-June) report has cited that the Current Sentiment Score scaled up from the previous quarter’s 57 to 63, in the optimistic zone. This is due to the continued resilience of the Indian economy amid a recessionary environment globally. The Current Sentiment Score signifies stakeholders’ current outlook in comparison to the preceding six months. During Q2 2023, the Future Sentiment Score rose from 61 in Q1 2023 to 64 in the optimistic territory as India’s macroeconomic indicators remained firm, despite headwinds on some parameters.

Current and Future Sentiment Scores

Source: Knight Frank India |Score >50: Optimism| Score =50: Neutral/Same| Score <50: Pessimism

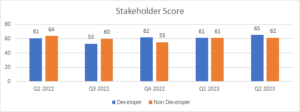

The Developer Future Sentiment score has increased from 61 in Q1 2023 to 65 in Q2 2023. With a momentary pause in interest rate hikes by the RBI, real estate developers remain optimistic about the next six months as the underlying demand for real estate remains firm.

The Non-Developer (the segment which includes banks, financial institutions, and PE funds) Future Sentiment score increased from 61 in Q1 2023 to 62 in Q2 2023. The institutional investors, who remained watchful in the past periods, indicated enhanced confidence in the Indian economy. The pause in the interest rate hike cycle by the RBI also influenced them positively.

Source: Knight Frank India |Score >50: Optimism| Score =50: Neutral/Same| Score <50: Pessimism

According to Shishir Baijal, Chairman and Managing Director, Knight Frank India, amidst turbulent global developments, India’s economy has firmly positioned itself as one of the world’s fastest-growing large economies, which has significantly influenced stakeholders’ sentiments in Q2 2023..The Future Sentiment Score therefore continued its positive trend, climbing from 61 in Q1 2023 to 64 in Q2 2023, mainly because the policy environment continues to support economic growth.. The zonal scores, as per Rajan Bandelkar, President Naredco surged in all zones except the South and the overall scores for all regions remained firm in the optimistic zone. This signifies a greater sense of confidence in the performance of these markets in the upcoming six months.

Robust Residential Market

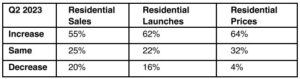

The residential market outlook reflects enhanced optimism in Q2 2023 as stakeholders remain confident on all parameters – sales, launches, and pricing for the next six months. In particular, the stakeholder sentiments on residential launches and pricing have only improved with each passing quarter since the past year. In Q2 2023, 55% of the survey respondents expected residential sales to increase in the next six months, compared to 48% who opined the same in the previous quarter. The pause in the interest rate hike cycle has spiked stakeholder sentiments about the sustenance of the current demand momentum in the next six months as the residential sector stands on a firm footing supported by policy measures and the rally witnessed in 2022.

In Q2 2023, 62% of the stakeholders opined that residential launches will improve in the next six months. In Q1 2023, 56% of the stakeholders held a similar view. With steady sales in the residential market, the stakeholder outlook towards the introduction of new launches remained robust. In Q2 2023, 64% of the survey respondents expect residential prices to increase in the next six months on the back of steady demand for residential property. In comparison, during Q1 2023, 61% of the survey respondents held a similar view.

Source: Knight Frank Research

Buoyant Office Market

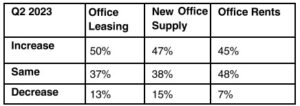

In Q2 2023, half of the survey respondents opined office leasing to increase in the next six months. In the previous quarter, 50% held a similar view. Despite a threat of recession in some major developed markets, stakeholders remained upbeat about the India growth story and resilience to continue in office leasing on account of strong demand from India-facing businesses, flex/co-working, and the rise of global capability centers in the country.

In Q2 2023, 47% of survey respondents expect office supply to improve in the next six months. In the previous quarter, 43% of survey respondents held a similar opinion. In Q2 2023, 45% of the survey respondents expect office rents to increase, whereas, in the previous quarter, 38% of the survey respondents held a similar view.

Source: Knight Frank India

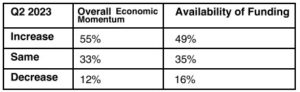

Based on the findings of the survey, stakeholder sentiments have only strengthened with each passing quarter on the back of overall economic momentum in the past year, with RBI’s policy intervention supporting growth.

Due to global geopolitical developments, stakeholder sentiments towards funding availability also improved as India has a very powerful appeal for attracting investments from foreign funds. In Q2 2023, 49% of stakeholders opined that the availability of funding would increase in the real estate sector in the next six months.

Source: Knight Frank India

Due to global geopolitical developments, stakeholder sentiments towards funding availability also improved as India has a very powerful appeal for attracting investments from foreign funds. And 49% of stakeholders opine that the availability of funding would increase in the real estate sector in the next six months.