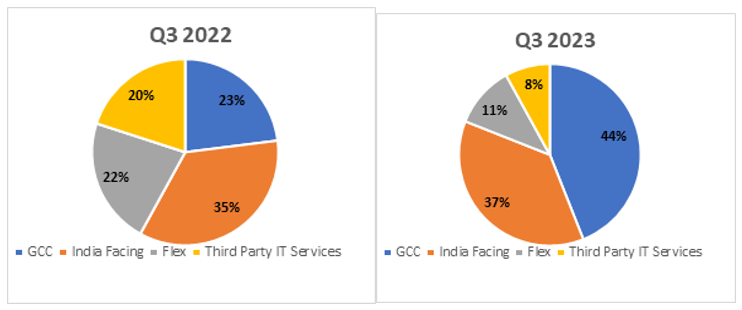

The elevated demand of the office market reflects the confidence of global occupiers, setting up and expanding their Global Capability Centres (GCCs) , constituting 44% of the office transactions in 2023.

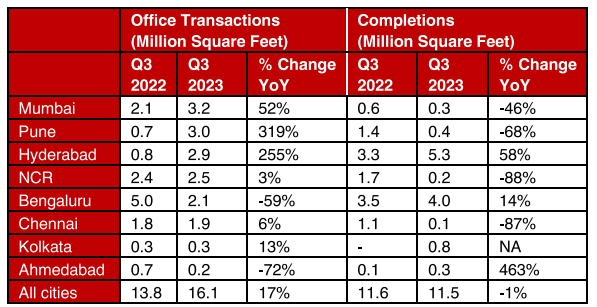

As per the latest report of Knight Frank India , the top eight markets of India registered office transactions of 16.1 million square feet , recording a growth of 17% YoY during Q3 2023. The elevated demand in the Indian office market reflects the confidence of occupiers as India continues to see economic stability despite global uncertainties. Global corporates have shown an increased commitment to their India operations by setting up or expanding their Global Capability Centres (GCC) in India . The comparatively brisk Indian economy continued to propel the India-Facing businesses or domestic corporations which constituted 37% of the office transactions accounting to 6 mn sq ft in Q3 2023. With 3.2 mn sq ft of transactions, Mumbai was the most active office market during Q3 2023 accounting for 20% of the total transactions during the period.

New office completions in Q3 2023 were recorded at 11.5 mn sq ft across the eight Indian cites led by Hyderabad accounting for 46% of the additional office space delivery with 5.3 mn sq ft, followed by Bengaluru with new office supply of 4.0 mn sq ft. Mumbai is the market with highest office rental at INR 113/sq ft/month, and Kolkata records the highest rental appreciation of 10% during the quarter.

According to Shishir Baijal, Chairman & Managing Director, Knight Frank India, the relative strength of the Indian economy continues to attract global corporate interest and is reflected in the recovering demand in the Indian office space market. The increasing incidence of GCCs being set up in the current quarter also points towards greater occupier commitment to the overall operational and business environment that India offers.

Occupier demand has trended up well over the year and looks to be on course to exceed levels seen in the previous year. It is the broader economic forces of inflation and GDP growth that will take center-stage in shaping the fortunes Indian office market in the next few months.”

Demand Supply Dynamics: Transactions up 17% YoY; New completions remain steady

Representing a healthy growth of 17% YoY, the Indian office market witnessed 16.1 mn sq ft of office space transacted during Q3 2023. Notably, Mumbai and Pune reached their highest quarterly transacted volumes since 2018, at 3.2 mn sq ft and 3 mn sq ft respectively. With transaction volume of 2.9 mn sq ft, Hyderabad market scaled a near three-year high in terms of quarterly transacted volumes on the back of the long-awaited supply which became available during the quarter.

Hyderabad with 5.3 mn sq ft accounted for 46% of the office space delivered during Q3 2023. In total, 11.5 mn sq ft of office space attained completion during Q3 2023 across the leading eight markets of India.

Source: Knight Frank India

GCCs and India-facing businesses dominate the leasing activities during Q3 2023

India’s resilient office market performance was led by the heightened activities by occupiers setting up Global Capability Centers (GCC) across markets. GCCs constituted 44% of the demand during the quarter as opposed to an average of 21% since Q1 2022. The occupier activity in this segment was particularly strong in Pune with 2.4 mn sq ft and Hyderabad with 2.2 mn sq ft of space transaction , constituting 81% and 75% of the total area transacted in these markets respectively, on account of GCCs.

India-Facing businesses continued to anchor the market and constituted 37% of the area transacted at 6.0 mn sq ft during Q3 2023. The activity in this segment was highest in Mumbai with 2.7 mn sq ft, followed by NCR with 1.33 mn sq ft and Bengaluru with 0.7 mn sq ft.

The occupier activities of Flex spaces and Third-Party IT Services was recorded at 1.79 mn sq ft and 1.2 mn sq ft, respectively. Flex spaces saw lower uptake due to lower speculative leasing in the quarter while the third party IT Services continued its trend of slower office consumption

End-use split of transactions in Q3 2023

Source: Knight Frank Research

Notes:

- India Facing: These refer to such transactions whose lessees/ buyers are businesses which have an India focused business. I.e: no export or import.

- Third party IT services: These refer to transactions whose lessees/ buyers are focused on providing IT and IT enabled services to offshore clients. They service multiple clients and are not necessarily owned by any of their clientele.

- Global Capability Center (GCC): These refer to transactions whose lessees/ buyers are focused on providing various services to a single offshore company. The offshore company has complete ownership of the entity that has transacted the space.

- Flex space: These refer to transactions by companies that specialise in providing comprehensive office space solutions for other businesses along with the benefits of flexibility of tenure, extent of services provided and the ability to scale higher or lower as required.

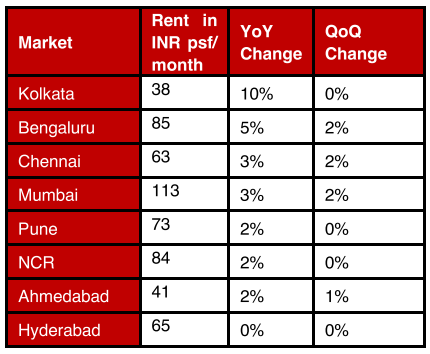

Sixth consecutive quarter to exhibit rental stability or growth

Rental values continued to grow or remain stable in both YoY and sequential terms across all markets in Q3 2023. Most significantly, this is the sixth consecutive quarter where YoY rent movement has been either stable or positive.

Kolkata, albeit on a low base, recorded the highest rental value appreciation of 10% during Q3 2023. Office rents in the larger office markets of Bengaluru, Mumbai and NCR grew by 5%, 3% and 2% YoY respectively. , Bengaluru’s rental growth was mostly led by a paucity of new Grade A spaces.Mumbai is the most expensive office rental market at INR 113/sq ft/month, followed by Bengaluru at INR 85/sq ft/month.

Average rent growth across markets during Q3 2023

Source: Knight Frank Research

Summing up Shishir Baijal says that occupier demand has trended up over the year and looks to be on course to exceed levels seen in the previous year. It is the broader economic forces of inflation and GDP growth that will take center stage in shaping the fortunes of the office market in the next few months.