As the momentum of robust residential sales continues unabated in the NCR, this prime residential market has seen a substantial decline in unsold inventory, largely driven by a combined share of affordable and mid-segment housing, fully supported by premium homes.

According to a latest research data of Anarock, residential property sales in Delhi-NCR skyrocketed since the pandemic and there are no indications of this momentum slackening in the second quarter of 2023. Unsold housing inventory in the region declined by over 21% annually – the steepest drop of available stock among all the top 7 cities.

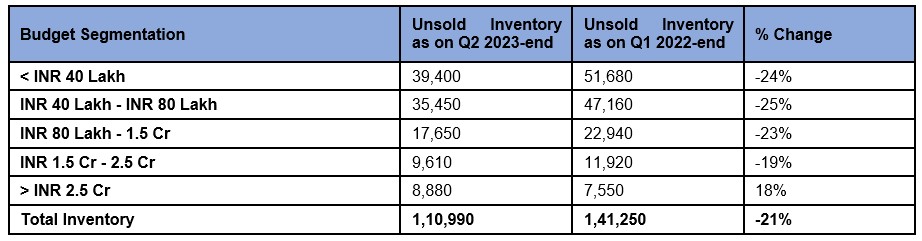

Delhi-NCR’s unsold stock as of Q2 2023-end stands at nearly. 1,10,990 units against approximately 1,41,250 units in the corresponding period of 2022. As per the segment wise figures, the Inventory of mid-segment homes priced (between INR 40 – 80 lakh) saw the highest yearly decline of 25% – from approximately 47,160 units at Q2 2022-end to about 35,450 units by Q2 2023-end.

Within the affordable housing category, unsold stock reduced by over 24% annually from about 51,680 units in Q2 2022 to about 39,400 units as of Q2 2023-end. Interestingly, new supply in this budget segment reduced by 19% annually – from approximately 1,570 units by Q2 2022-end to approximately 1,260 units as of Q2 2023. The moderated new supply pipeline helped developers clear their previous stock. Premium homes witnessed an over 23% y-o-y decline in unsold stock. As on Q2 2022-end, nearly. 22,940 units were unsold in NCR in this budget category; by Q2 2023-end, it had declined to about 17,650 units.

Luxury homes (priced INR 1.5 Cr – INR 2.5 Cr) saw unsold inventory reduce from approximately 11,920 units by Q2 2022-end to approximately 9,610 units by Q2 2023-end – a19% annual drop. Ultra-luxury homes (priced >INR 2.5 Cr), on the other hand, saw available inventory rise by 18% annually amid increased new supply in this category over the last few quarters. The current stock of ultra-luxury housing in NCR currently stands at approximately 8,880 units – the lowest among all budget categories.

Source: ANAROCK Research

According to Santhosh Kumar, Vice Chairman, Anarock Group, the increasing sway of branded developers has been steadily boosting homebuyer confidence in Delhi-NCR. Before the pandemic, this market was being burdened by excessive supply from unbranded players. Today, despite very healthy sales, branded developers are carefully calibrating the supply pipeline. Besides the yearly drop, if we consider pre-Covid Q2 2019-end period, there has been a 39% reduction in overall unsold housing stock in the whole of NCR.”

NCR City- Wise Analysis

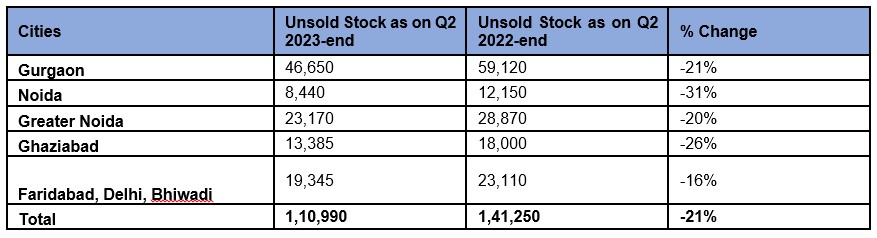

Currently, Gurgaon has the maximum unsold stock of approximately 46,650 units, followed by Greater Noida with approximately 23,170 units. Noida has the least unsold stock of approx. 8,440 units as of Q2 2023-end.

In terms of yearly change, Noida saw the maximum yearly decline of 31%, followed by Ghaziabad (26%), Gurgaon (21%) and Greater Noida (20%). Gurgaon took the third spot since it saw a lot of new supply added in the last 1-2 years.

Source: ANAROCK Research

- Noida: Unsold stock down 31% annually – from approx. 12,150 units by Q2 2022-end to approx. 8,440 units by Q2 2023-end.

- Ghaziabad: Unsold stock down 26% annually – from approx. 18,000 units by Q2 2022-end to approx. 13,385 units by Q2 2023-end.

- Gurgaon: Unsold stock down 21% – from approx. 59,120 units by Q2 2022-end to approx. 46,650 units by Q2 2023-end.

- Greater Noida: Unsold stock down 20% annually – from approx. 28,870 units by Q2 2022 to approx. 23,170 units by Q2 2023-end.

- Faridabad, Delhi & Bhiwadi: Cumulative unsold stock down 16% annually – from approx. 23,110 units by Q2 2022 to approx. 19,345 units by Q2 2023-end.