Tier 2 cities are fast coming up as the next growth frontier for the office sector with several cities emerging as new ground for flex office operators.

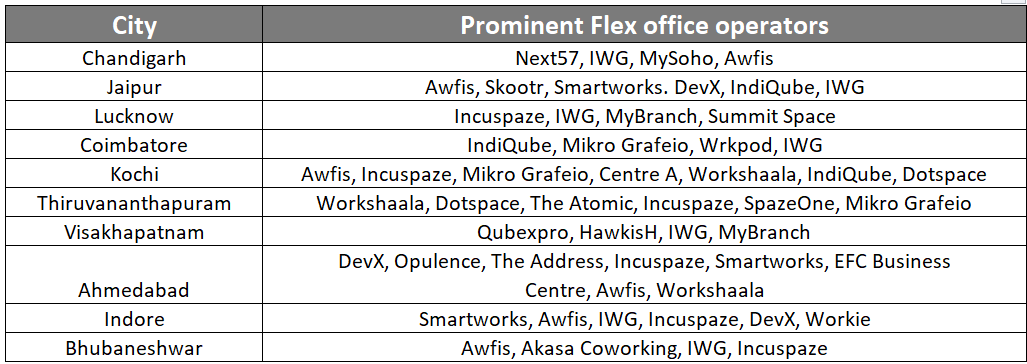

According to a recent report by consulting firm CBRE, 26 major flex office operators have recorded their presence in 10 key cities of Chandigarh, Jaipur, Lucknow, Coimbatore, Kochi, Thiruvananthapuram, Vishakhapatnam, Ahmedabad, Indore, and Bhubaneshwar. As per the report, flexible workspace operators are recognising the potential of these markets and are rapidly expanding their presence, providing options for start-ups and established firms.

Among the key Tier 2 cities, Ahmedabad has the highest flex stock, with more than 0.5 mn. sq. ft. as of September ’23. Other cities, including Chandigarh, Jaipur, Coimbatore, Kochi and Indore, have flex stock between 0.3-0.5 mn. sq. ft. Lucknow, Thiruvananthapuram, Visakhapatnam and Bhubaneswar have flex office stock lower than 0.3 mn sq. ft. Prominent flex operators such as Awfis and Incuspaze recorded presence in more than 5 cities, including Jaipur, Kochi, Lucknow, Thiruvananthapuram, Ahmedabad, Indore and Bhubaneswar. Other players who forayed into these cities include IWG, IndiQube and Smartworks, among others.

The overall office absorption across the 10 cities stood at 1.6 mn sq. ft., led by Ahmedabad, Jaipur, and Thiruvananthapuram. The total office stock in these 10 Tier 2 cities stood at 68 mn sqft with Ahmedabad, Kochi and Thiruvananthapuram, each boasting office stock higher than 7.5 mn sq ft. The total office supply recorded in these 10 cities was 3.4 mn. sq. ft. The top cities dominating supply addition in CY2023 include Ahmedabad, Kochi, and Indore.

With their growing talent pool, competitive real estate costs, and improving infrastructure, key Tier 2 cities are well-positioned to attract more businesses in the future. The sectoral drivers of office space demand in Tier-2 cities include IT, Technology, flexible space operators, e-commerce start-ups, technology GCCs, consulting and advisory GCCs, and Indian BFSI firms.

Traditionally, office spaces in smaller cities have been dominated by Grade B buildings, characterised by smaller floor plates, and limited amenities. However, recognising the growing demand, Tier-2 cities have been witnessing the development of modern office parks. Says Anshuman Magazine, Chairman & CEO, India, South East Asia, Middle East & Africa, CBRE, ” Non-metros, referred to as Tier-2 and Tier-3 cities, have primarily been seen as residential or industrial centres, developing as hubs of trade and businesses over decades. The growth of micro, small and medium-sized enterprises (MSMEs) has been a key driver of economic activity in non-metro cities. India Inc. and numerous MNCs are increasingly setting up offices in Tier-2 cities, capitalising on cost-effective real estate and the availability of talented professionals. This trend is further bolstered by the rise of local start-ups and the expansion of established start-ups into these smaller markets. Looking ahead, IT and technology companies are expected to be at the forefront of this shift towards smaller cities. A surge in the number of companies setting up their global capability centres in select Tier-2 cities is also expected”.

Adds Ram Chandani, Managing Director , Advisory & Transactions Services, CBRE India , ” Over the next few years, Tier-2 cities would witness a higher number of modern office developments, including flex spaces replete with amenities that are appealing to global and domestic occupiers. Global and domestic firms are likely to adopt several entry strategies to establish and expand their footprint. Established IT services firms would likely explore campuses for their offices. Global firms are likely to see the appeal of Tier-2 cities for their GCCs, aided by cost considerations and the availability of skilled talent. As occupiers mark their entry in Tier-2 cities and the quality of life improves, talent retention in these cities would emerge as a game-changer. Further, prominent developers would bring international standards and a proven track record to enhance the real estate profile of Tier-2 cities. ”