With the interest rate hike cycle topping out, the residential real estate cycle is unlikely to face any material headwinds and demand is expected to remain healthy for at least the next two-three years, driven by leading listed companies.

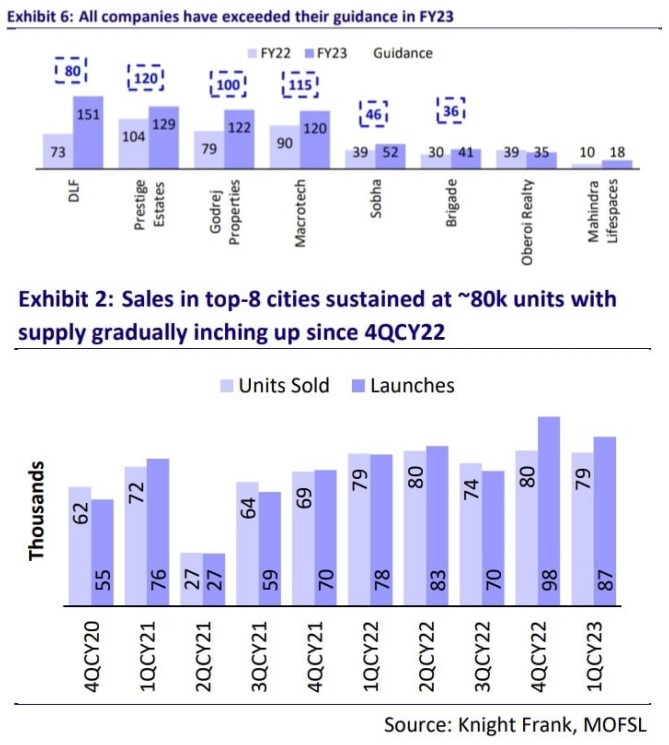

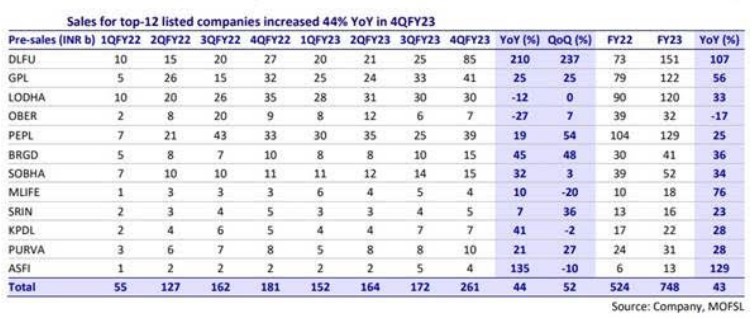

According to Motilal Oswal Financial Services (MOFSL) ,the top listed real estate companies ended FY23 on a high note as they delivered 44% YoY growth in pre-sales in 4QFY23 to INR261b, with 4Q turning out to be the best quarter for most of the companies. Top-12 companies cumulatively reported INR748b in pre-sales in FY23, up 43% YoY. MOFSL coverage universe posted 46% growth in pre-sales in 4QFY23 and 43% YoY growth in FY23 to INR665b, beating FY23 guidance/initial estimates by 18%. Among companies, DLF delivered a standout performance in FY23 as its pre-sales doubled YoY to INR150b on account of INR80b of bookings from its project launch (The Arbour) in Sector 63, Gurugram, which was fully sold out. Even excluding DLF, the MOFSL coverage universe delivered healthy 32% growth in pre-sales.

At the beginning of FY23, inventory for most of the top-10 listed real estate players was below 12 months, which compelled them to scale up the launches in FY23 to INR740b from INR390b in FY22. Despite higher launches, the inventory overhang remained at 12 months at the end of FY23 for most of the companies due to a better churn rate and improved sales velocity. MOFSL coverage universe now plans to launch over INR1 trillion worth of projects in FY24, which will drive 16% growth in bookings in FY24 to INR760b.

In FY23, MOFSL coverage universe witnessed a 17% YoY rise in realization. For OBER and DLF, blended realization grew 29% YoY, aided by an enhanced share of luxury projects in pre-sales. Similarly, PEPL increased its share of Mumbai projects, which resulted in 25% growth in ASP. While the product mix benefitted the ASP for other companies too, a large part of growth was primarily driven by price hikes. With concerns about rising construction costs comfortably put to rest, the improving product mix and sustainable price hikes by companies can translate into margin improvement, which will boost profitability.

With interest rates likely to have peaked out, a major headwind is now behind us. The absorption for top-8 cities remained at 80,000 units for the last four to five quarters and is now expected to pick up with renewed interest from first-time homebuyers. Industry growth will also be complemented by consistent market share gains by large developers on the back of increased penetration into at least a couple more markets.