Subtotal ₹0.00

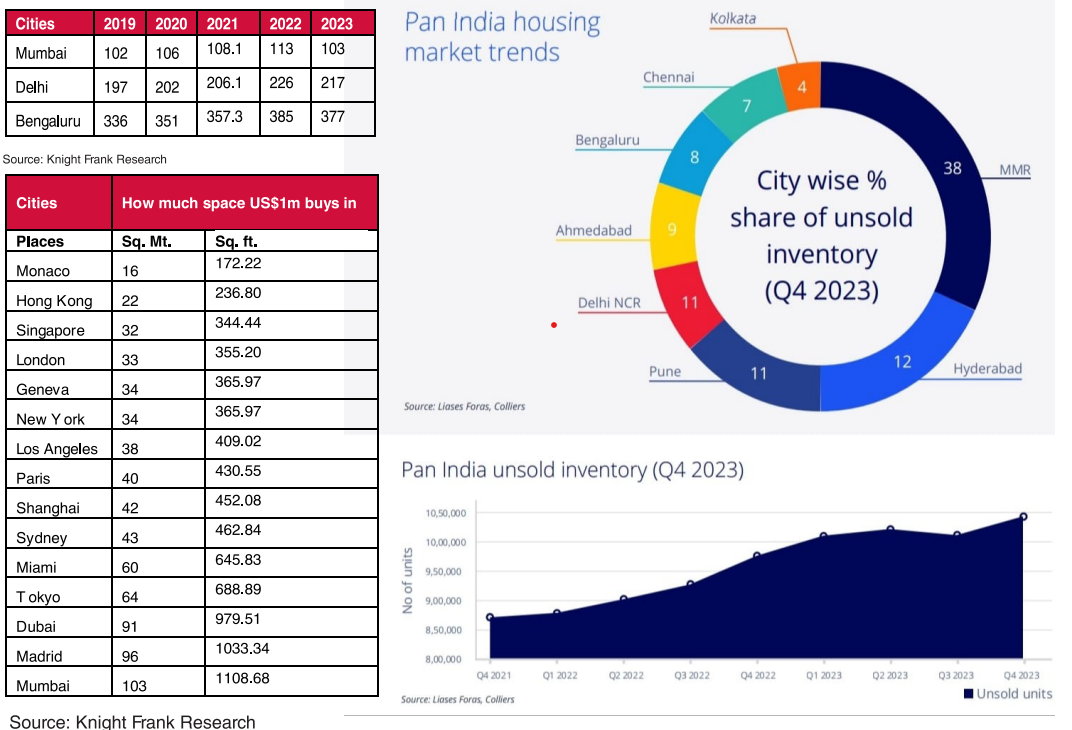

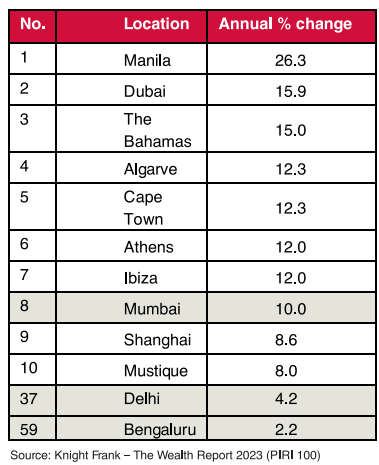

Mumbai has earned a place among top 10 leading global luxury residential markets while Delhi and Bengaluru occupy 37th and 59th positions.

According to Knight Frank 2023 Wealth Report of 100 luxury residential markets,Mumbai ranked 8th on Knight Frank’s PIRI’s index in 2023 as compared 37th rank in 2022 which is a phenomenal jump of 10% year on year growth in terms of annual luxury residential price rise. This jump has marked a place for Mumbai in the top 10 leading luxury residential markets. Delhi ranked 37th and showcased rise of 4.2% YoY in 2023 as compared to 77th rank in 2022. Bengaluru stands at 59th rank compared to 63rd in 2022 recording a 2.2% YoY increase in 2023.

The PIRI 100: Luxury residential markets’ performance, annual price change (2022 – 2023)

All price changes are in local currency

Shishir Baijal, Chairman & Managing Director, Knight Frank India, said, “India’s luxury residential market has shown remarkable growth, as highlighted in Knight Frank’s Wealth Report 2024. Mumbai’s ascent to the 8th rank globally, with a staggering 10% year-on-year increase in luxury residential prices, underscores the city’s enduring appeal. While Mumbai logged into the top 10 league among PIRI 100 cities, Delhi and Bengaluru also demonstrated positive momentum by improving their ranks.

The outlook for 2024 remains bright as Mumbai with a 5.5% prime price growth forecast, ranks second among the 25 cities globally. As we navigate the complexities of the global market, India’s emergence as a prime destination for luxury real estate investment is undeniable.”

Monaco continues its reign as the world’s most expensive real estate market where US$ 1 million can get you 16 square metres (sq. mt.) of space, followed by Hong Kong (22 sq. mt.) and Singapore (32 sq. mt.) in 2023. For US$ 1 million, Mumbai offers for purchase 103 sq. mt. of prime residential space, marking a reduction in space purchase of 8.85% YoY compared to 113 sq. mt. in 2022. Comparatively in Delhi, one can purchase 217 sq. mt. which accounts to reduction of 3.98% from 226 sq. mt. in 2022. Bengaluru recorded a 2.12% space reduction from 385 sq. mt. in 2022 to 377 sq. mt. in 2023.

Area (in square meters) purchasable for US$1 million over the last 5 years for Mumbai, Delhi and Bengaluru: