Subtotal ₹0.00

In the backdrop of the improvement in the affordability index last year and considering the much-expected cut in the interest rates this year, homes are likely to become more affordable in 2024.

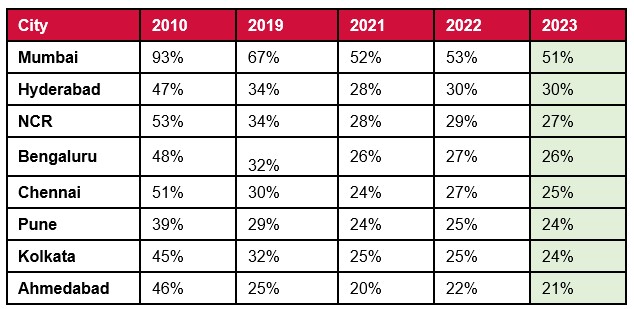

Ahemadabad , Kolkata and Pune have emerged as the most affordable residential markets.According to Knight Frank India’s proprietary Affordability Index , the EMI (Equated Monthly Instalment) to income ratio for households has improved in 2023 after the brief decline in affordability in 2022. Home affordability across cities also significantly improved since pre-pandemic year of 2019. Expected moderation in inflation and projected downward trend in interest rates a should further improve home affordability in 2024.

Ahmedabad remains the most affordable housing market in the country with an affordability ratio of 21% which implies that on an average a household in Ahmedabad needs to spend 21% of its household income to pay EMI for housing loans. Ahmedabad is followed by Kolkata and Pune at 24% each .

Kolkata occupies second place with an affordability index of 24 percent . The ratio level of the city has improved by 1% from 2022 and by 8% from the pre-pandemic year of 2019.Mumbai is the only city beyond the affordability threshold of 50%, a level exceeding which banks rarely underwrite a mortgage. The most expensive residential market of the country has however seen an improvement of 2% in its affordability index measured at 51% in 2023 from 53% in 2022. Looking at the trend from the pre-pandemic period, the city has witnessed a significant improvement of 16 percent in its affordability levels from 67 percent in 2019.

Hyderabad is the second most expensive residential market in the country. The affordability index of Hyderabad, the second most expensive residential market, remained unchanged at 30% as home prices increased by a prolific 11% in 2023.

National Capital Region (NCR) has seen its affordability index improve to 27% in 2023 from 29% in 2022.

Bengaluru is the fourth most expensive market with affordability index of 26% in 2023. The ratio of city has improved marginally by 1% since 2022 and 6% from the pre pandemic year of 2019.

Affordability Index of Chennai has improved by 2% from 27% in 2022 to 25% in 2023.

Affordability Matrix

Note: (1) Calculated as EMI/INCOME ratio

(2) City-wide average affordability statistics cannot highlight disparities in housing costs within sub-markets or across the income spectrum. Source: MOSPI, Knight Frank Research According to Shishir Baijal, Chairman and Managing Director, Knight Frank India, Anticipating stable GDP growth and moderation in inflation in FY 2024-25, affordability is expected to strengthen. Further, the lowering of the repo rate later in 2024 as is widely expected from the RBI, will lead to a reduction in home loan interest rates. This would considerably enhance the affordability of homes in 2024, providing a comprehensive boost to the sector.

Further in the election year of 2024, the government may offer budgetary sops for the housing sector, thereby making homes more affordable.