Subtotal ₹0.00

Emkay Global Financial Services has launched coverage on India’s real estate sector, highlighting a more disciplined housing cycle, stronger balance sheets, and robust end-user demand that continues to favour well-capitalised, branded developers.

With listed players doubling their residential pre-sales share over the past decade and regulatory reforms boosting execution standards, the brokerage believes the sector is poised for sustained, broad-based growth—particularly among small and mid-sized developers, according to a report by Business Standard.

India’s housing upcycle, Emkay believes, has entered a more mature and disciplined phase compared with earlier cycles. Over the past decade, listed and organised developers have steadily gained market share, doubling their share of residential pre-sales to around 15 per cent as of financial year 2024-25 (FY25).

This structural shift, driven partly by regulatory reforms such as RERA, has improved execution standards and strengthened buyer confidence, the brokerage said.

In this backdrop, Emkay Global thinks small and medium (SMID) real estate players could likely outperform with 25-35 per cent pre-sales CAGR over FY25-28, given a favorable base and ability to gain market share. It, thus, has assigned a ‘Buy’ rating on Lodha Developers, Sunteck Realty, and Arvind Smartspaces, an ‘Add’ rating on DLF, and a ‘Reduce’ rating on Oberoi Realty.

Among these, Lodha is its preferred large-cap play, while Sunteck Realty, and Arvind Smartspaces stand out in the mid-sized segment due to stronger growth visibility and attractive valuations.

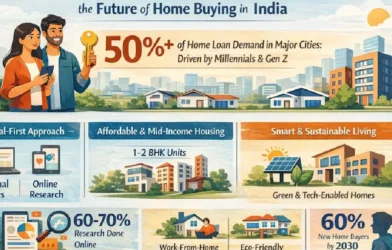

As per Emkay Global analysts, India’s housing demand is expected to remain resilient in the coming years, supported by a preference for home ownership, stable affordability levels across major cities, and gradually easing interest rates. Even as property prices have risen over the past few years, the brokerage believes affordability metrics remain comfortable in most large urban markets, suggesting room for demand to sustain, especially in the mid-income and premium segments.

“We have witnessed disciplined demand-supply dynamics in the current housing upcycle. Absorption has been mostly ahead of new launches, which has led to a significant decline in unsold inventory in the top-8 cities during this period. Premiumisation has continued. Even with the ongoing trend of preference for larger spaces, we have still not reached the level of 1,100-1,350 sq ft (weighted average size of a unit sold) seen in the top-8 cities over FY09-15, suggesting headroom for growth,” it said.

Homebuyers, according to Emkay Global, are more confident in purchasing under-construction inventory, now, following RERA implementation, mainly from branded/well known developers.

The number of units absorbed from new launches, it said, has been rising since FY17, which affirms increasing consumer comfort. Also, the share of ‘absorption from new launches’ in the overall absorption in the top-8 cities has increased from 26 per cent in FY21 to 38 per cent in FY25.

This confidence in Branded Developers stems from the sharp improvement in balance sheets across the sector.

“The major listed developers (operational since FY09) had a 7-per cent market share in top-8 cities at the peak of the earlier cycle in FY11. This has doubled to 15 per cent as of FY25. Also, net debt of prudent players in the listed space has reduced by nearly 65 per cent as of FY25, from the peak in FY17. Further, developers added more projects that were asset-light in nature, which enabled scalability without straining the balance sheet,” Emkay Global said.