Subtotal ₹0.00

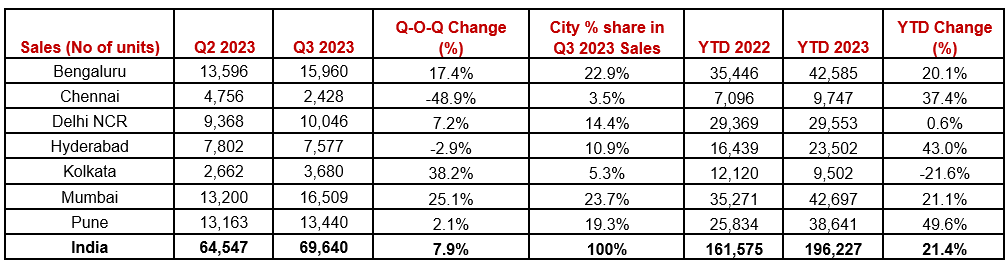

As at the beginning of the festive season housing sales registered a YoY growth of 21.4% during the January to September 2023 period, residential real estate during the festive quarter of October-December is poised to outperform the high housing sales registered in 2022.

During the first nine months of 2023, residential sales of 196,220 units were recorded in top 7 cities. According to a recent JLL report residential sales have already touched 91% of 2022 sales and is likely to surpass 215000 units by the end of 2023.

“Residential market in Q3 2023, recorded the highest quarterly sales since 2008 as the high-end segment contributed most of the demand. The robust quarterly sales at 69,600 units were backed by commensurate quality launches by the developers. On a sequential basis, sales saw an uptick of 7.9% in Q3 2023. It is interesting to note that residential sales broke all records with average quarterly sales of over 65,000 units till the third quarter of 2023. The prominent launches by branded developers saw good sales traction across all the 7 cities. Also, the consecutive fourth pause in policy rate by the RBI will have a positive impact on the residential sales as the financial institutions will maintain the home loan interest rates at the present levels” said Siva Krishnan, Head – Residential, India, JLL.

Mumbai & Bengaluru Drive Quarterly Residential Sales

Mumbai and Bengaluru led the Q3 sales, accounting for 46.6% share. Mumbai sprang to the top with 23.7% share recording sales of more than 16,500 units. Bengaluru was not far behind with 22.9% share. It is pertinent to note that Pune and Delhi NCR also recorded healthy sales backed by quality launches by branded developers. If we analyze the quarterly sales growth data, except Chennai and Hyderabad all the cities have seen an increase in sales as compared to the previous quarter.

Note: Mumbai includes Mumbai city, Mumbai suburbs, Thane city, and Navi Mumbai. Data includes only apartments. Rowhouses, villas, and plotted developments are excluded from this analysis. Source: Real Estate Intelligence Service (REIS), JLL Research

“The robust sales in Q3 as well as the first nine months of 2023 indicates unrelenting buyer activity in the Indian residential market on the back of steady growth in employment and income and sustained affordability. On a YTD comparison, sales increased by over 21% led by Mumbai, followed by Bengaluru. The synergy between steady interest rates and the ongoing festive season sentiment will lead to 2023 sales clearly outpacing last year’s numbers to a new high. There is a possibility of policy rate cut in 2024 provided the GDP growth and inflation support such a stance of RBI. In that scenario, we would likely see a further growth trajectory in the residential sector.” said Dr. Samantak Das, Chief Economist and Head – Research & REIS, India, JLL.

Premium Segment Share On Top

Note: Mumbai includes Mumbai city, Mumbai suburbs, Thane city, and Navi Mumbai. Data includes only apartments. Rowhouses, villas, and plotted developments are excluded from this analysis. Source: Real Estate Intelligence Service (REIS), JLL Research

One differentiating trend that emerged during Q3 2023 was that the premium segment priced above INR 1.5 crore had the highest contribution (24.3%) of the quarterly sales. This shows the increasing appetite of buyers towards larger homes with superlative amenities and specifications. Also, it is seen that homeowners are upgrading to bigger homes as developers are launching such projects taking cognizance of this demand trend. The share of all other segments except the premium, declined sequentially in Q3 2023.

Interestingly, growth in sales of premium segment is significantly higher compared to that of other segments. It grew by 36.4% q-o-q vis-à-vis only 2.3% in the most affordable segment.

On the back of robust demand, there is an increase in residential prices across the bigger residential markets. Bengaluru witnessed the maximum appreciation in prices to the tune of 14.8% on a yearly basis while in Mumbai prices increased by around 10.3%. Delhi NCR also saw on an average 8.5% rise in capital values. New launches as well as new phases of existing projects have also entered the market at higher prices in some cities.

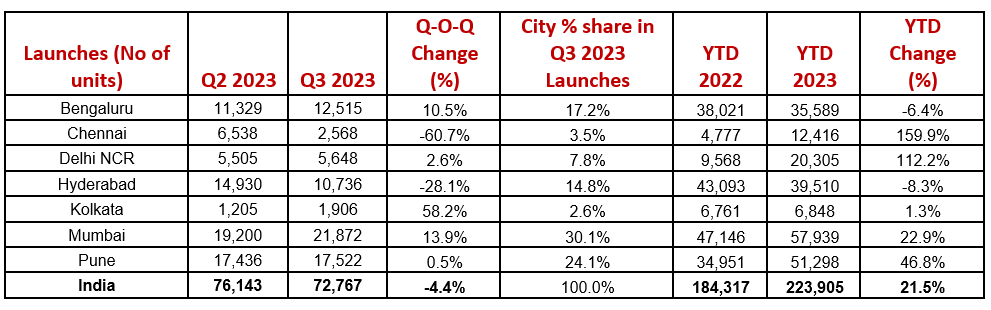

Launches Witness Healthy Growth

Despite a marginal decline in the pace of launches during Q3 2023, the first nine months clocked a robust YoY growth of 21.5% at 223, 905 units. More than half of the launches (54.1%) were recorded in Mumbai and Pune. In line with the sales trend, majority of the new launches in Q3 2023, were in the premium segment (apartments in the price bracket of above Rs 1.50 crore with a share of 43.2%.

Unsold inventory See Marginal Increase

As of Q3 2023, unsold inventory, at various stages of construction across the top seven cities of India increased by 0.6% on a q-o-q basis with new launches outpacing sales. Mumbai, Hyderabad, and Bengaluru together accounted for 64% of the unsold stock. An assessment of years to sell (YTS*) shows that the expected time to liquidate the stock has declined from 2.5 years in Q2 2023 to 2.3 years in Q3 2023, indicating robust sales growth.

Outlook

Going forward, the demand for residential apartments will be backed by robust supply pipeline as some branded developers have announced new launches and entry into newer markets including peripheral micro markets where infrastructure augmentation is in process or planned. Moreover, strategic land acquisitions in prime locations as well as in growth corridors to strengthen the supply is taking place across the country. Therefore, residential market is expected to remain buoyant and achieve next wave of growth and expansion with good response from the buyers in mid as well as premium segment.