Subtotal ₹0.00

Driven by strong demand for quality supply and a clear shift towards experiential formats across major cities, the retail leasing ducked global headwinds to touch a new peak.

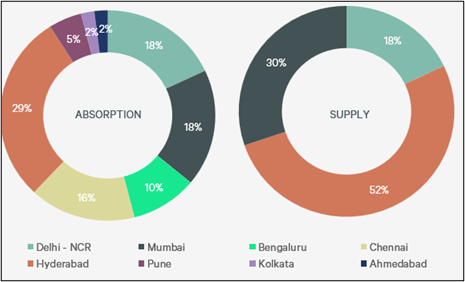

According to a CBRE report ,leasing by retail firms across the top cities touched a peak of ~8.9 million sq. ft. in 2025. At the same time, total supply during the year was recorded at ~4.3 million sq. ft., 268% higher than in 2024. Hyderabad accounted for over half of these supply additions, followed by Mumbai and Delhi-NCR.During H2 2025 period, about 2.1 million sq. ft. of new retail supply became operational.

“Retailers are increasingly experimenting with innovative store formats to boost customer visits, dwell time, and brand engagement. Leasing momentum is being fuelled by retailers’ emphasis on experiential flagship stores, kiosks, and Gen Z-focused store formats further giving a boost to customer visits, dwell time and brand engagement. The record leasing volumes in 2025 reflect a decisive shift towards quality-led, experience-driven growth,” said Anshuman Magazine, Chairman & CEO, South-East Asia, Middle East & africa, CBRE

Retail space take-up increased significantly in H2 2025, reaching ~5.6 million sq. ft.; led by Hyderabad (34% share), Delhi-NCR (20%), and Chennai (16%).

With a ~48% share, Fashion & Apparel players dominated leasing activity during the year. New store openings within this segment remained diverse, encompassing sustainable labels, streetwear / youth-centric, ethnic / fusion wear, athleisure, luxury / designer, and direct-to-consumer (D2C) brands.

AI-driven technologies are further underpinning this transformation, enabling hyper-personalised styling through generative AI, virtual try-ons, social sharing to reduce returns and manage inventory through predictive modelling.

Furthermore, Food & Beverage (F&B) formats accounted for ~12% of total leasing volume during the year, driven by a preference for large-format, experiential units in both premium malls and high street hubs. Jewellery brands followed with an ~8% share. Notably, the tenant mix in this segment is evolving beyond traditional gold, with lab-grown diamond (LGD) brands spearheading store expansions.

According to Ram Chandani, Managing Director, Leasing Services, CBRE India, during the second half of the year, retailers also capitalised on the country’s consumption uptrend, supported by low inflationary trends, revisions to income tax rates, and the rationalisation of goods and services tax (GST).While retail leasing activity continues to be dominated by domestic players, international retailers remain active. Among domestic players, D2C brands continue to focus on offline expansion to improve execution and long-term viability.These brands accounted for ~27% of total retail leasing in 2025.

Entertainment zones at the retail spaces have evolved into high-tech hubs that leverage edutainment, virtual reality (VR), and gamified radio frequency identification (RFID) loyalty systems to command premium pricing and drive repeat visitation.