Subtotal ₹0.00

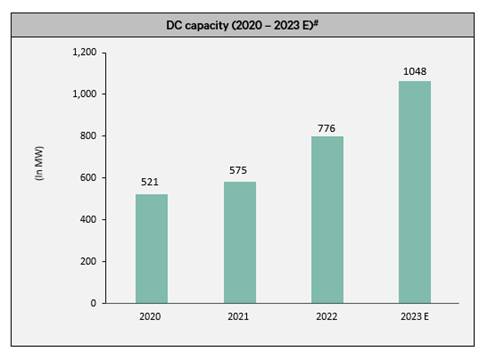

With nearly 500 MW currently under construction across several cities, Data Centre capacity is expected to touch 1048 MW by the end of 2023 and top 1300 MW by the end of 2024. Mumbai, Delhi-NCR, and Chennai dominate data centers stock with 80 percent combined share.

According to the Colliers report, aligning with the country’s progressive digital landscape, the Indian DC industry is witnessing a continuous uptrend owing to rapid digitalization, enhanced tech infrastructure, and the inclusion of advanced technologies such as 5G, Artificial Intelligence (AI), blockchain, and cloud computing.

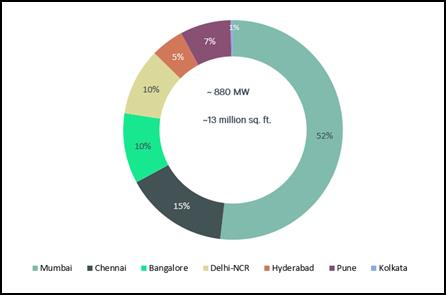

As per the report, India’s DC capacity has doubled over the last four-five years to reach 880 MW as of June 2023 and is expected to increase further to touch 1,048 MW by the end of 2023. During Jan-Jun 2023, the DC stock in the top 7 cities in India stood at 880 MW capacity spanning over 13 million sq. ft. Mumbai, Chennai, Bangalore, and Delhi-NCR accounted for about 87% of the country’s DC stock as of June 2023. Overall, DC occupancy levels in India stood at about 75 – 80 percent in Jan-Jun’23, which is likely to improve further by the end of the year.

Mumbai continues to be the most prominent DC market in the country, accounting for more than half of the total stock at 52 percent. The city is expected to lead the supply addition with a 46% share of the upcoming 500 MW by the end of 2024. The presence of multiple cable landing stations, inclusive government initiatives, and well-rooted entertainment and finance industries have established the city as a top destination for BFSI, media, cloud, and OTT companies to locate their DC operations. Chennai has also emerged as a key established tier 1-DC market in India, accounting for 21% of the total stock in the top 7 cities as of Jun’23. The city is expected to account for a 21% share of the upcoming 500 MW supply by the end of 2024. Until Jun’23, Bangalore and Delhi-NCR accounted for 10% of DC stock each.

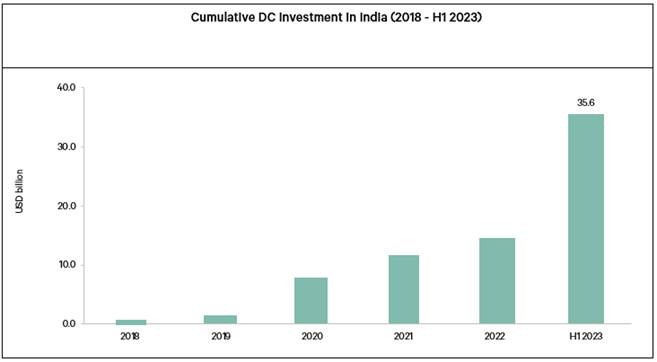

- Further, the country’s growing digital infrastructure, increasing technology penetration, and proactive regulatory push have made it an attractive destination for DC investments. During the 2018 – June’23 period, the DC market in India attracted investment commitments of about USD 35 billion by both global and domestic investors, the report highlighted. Hyperscale DCs dominated most of the DC investments with a share of about 89%, while colocation DCs contributed to the rest of 11%. The top states that dominated the cumulative investment commitments include Maharashtra, Tamil Nadu, West Bengal, and Uttar Pradesh.

According to Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, heightened interest from investors looking to capitalize on DC’s attractiveness as a preferred alternate real estate option in the country is anticipated. Multiple state governments in India have been giving an enormous push to the DC segment in the country, with dedicated policies/incentives introduced to attract both global and domestic investors. Most of the states have also declared DCs under ‘essential services’ to ensure uninterrupted operations throughout the year. Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, says that technology companies, along with corporates from sectors such as BFSI, Cloud Services and OTT platforms will continue to drive DC demand in India. . Though the DC industry is witnessing an expansion in tier-I cities, leading hyperscalers and cloud service providers are also likely to expand to tier-II cities to capture the growing demand among BFSI firms and online streaming platforms to establish DC facilities closer to the consumption hubs.

Outlook for Data Centers

- Technology firms, BFSI companies, cloud services and OTT platforms would continue to be key demand drivers for both colocation and hyperscale DC facilities

- Several engineering & manufacturing firms and technology companies are also likely to set up DCs for R&D labs

- The exponential growth in AI-generated data workload is expected to drive demand for high power density DC facilities (~ more than 30kW / rack) as compared to traditional power density facilities (~ 8-10kW / rack)

- PSUs and other government enterprises would continue to focus on the deployment of operations to third-party colocation DCs

- Small- to medium-sized corporates would continue to gradually shift operations from enterprise to colocation DCs

- DC operators are also likely to expand in tier-II DC markets to capture the growing demand among BFSI firms and online steaming platforms to establish DC facilities closer to the consumption hubs

- Operators should provide tailor-made streamlined DC solutions along with scalability options to attract occupiers looking for flexibility/agility in the future

- Increased focus on sustainability measures and minimizing energy usage would achieve cost efficiencies

- DC investors should continuously explore opportunities to upgrade facilities to increase efficiencies, reduce costs and support the environment through smart investments, IT strategies and energy management

- ESG, machine learning and AI are likely to take center stage in DC investments

- In addition to power and infrastructure availability, regulatory hurdles in terms of land acquisition and delays in approvals are expected be a key challenge for investors in select cities

- Build-to-suit, acquisition, and equity investments remain the preferred investment routes into the sector in India. Investors are also likely to form partnerships with experienced operators and developers to gain exposure to the sector. This approach enables investors to leverage their partner’s expertise in areas such as site selection, operations, and regulatory compliance.