Subtotal ₹0.00

Gurgaon-based Signature Global that had made its mark as a leading developer of affordable housing in not just NCR but across the country, is now making strides in the mid and upper-mid housing. Riding high on the runway success of its newly launched IPO, the company is scaling new heights with its per sq ft realization nearing Rs 10000. In this exclusive interaction with Torbit Realty, Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Limited and Chairman, Assocham National Council on Real Estate, Housing and Urban Development, talks about the post-IPO path for Signature Global , especially the business plans for 2024, upcoming post-poll full budget and prospects for the real estate sector. Excerpts. Vinod Behl

What lead to the super success of your IPO? What is the post IPO path for Signature Global?

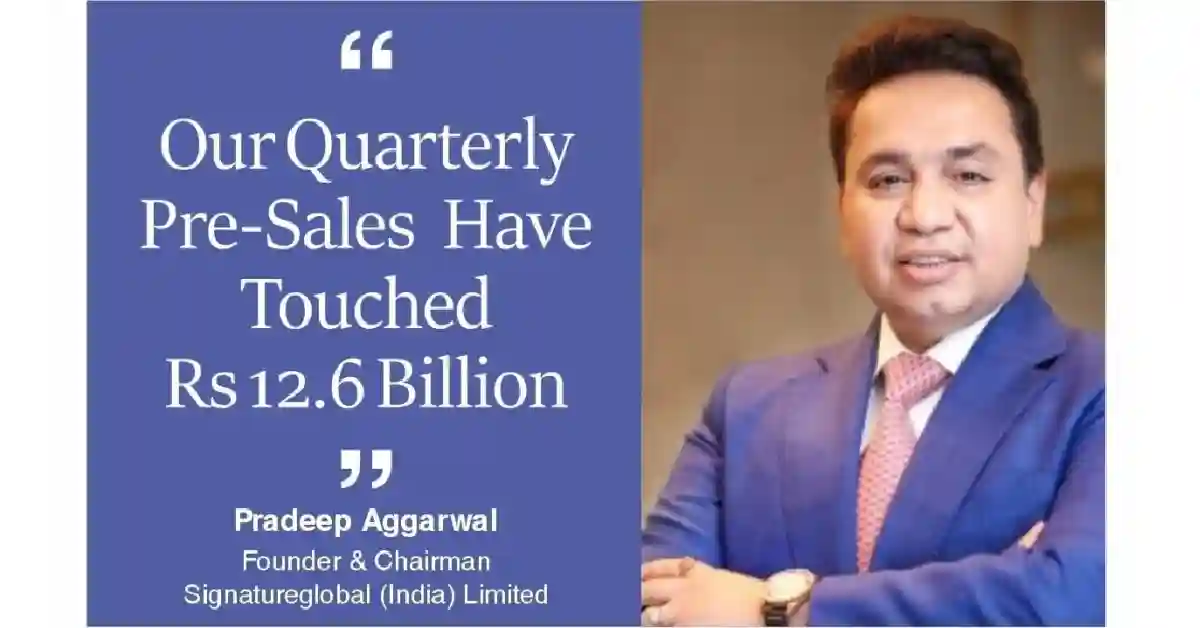

Signature Global has corporate governance at the centre of its business, which has helped us build strong trust amongst stakeholders and investors. It is due to the strong rapport built with the investors with the help of our transparent and credible business practices that Signature Global witnessed a robust stock performance post its IPO. The stock has more than tripled since the IPO launch and this impressive growth has elevated the stock’s valuation compared to its peers, standing at 3X pre-sales and 12X adjusted EBITDA. Despite the premium, the company maintains a strong pre-sales trend, with the latest quarterly pre-sales reaching Rs12.6 billion in 3QFY24, showcasing a substantial 47 percent year on year and 29 percent quarter on quarter growth. Additionally, company’s per sq ft realization improved significantly to Rs 9,640, indicating strong pricing momentum in the Gurgaon/Sohna markets.

What kind of returns Signature Global properties have delivered over the last few years?

Like most products in the Indian market, even the real estate sector is highly consumer segment specific. So, various segments would perform differently, with variable response. Affordable homes developed by Signature Global have delivered impressive returns, with values more than doubling over the last five years. This indicates a significant appreciation in value for individuals who invested in these properties. For mid-income properties, the returns have been good too, typically ranging between 40-50 percent. People who have invested with us in this segment , are enjoying healthy returns on their investment. Properties developed under the Deen Dayal Jan Awas Yojana (DDJAY) scheme, such as independent floors, have also seen favourable returns. While specific figures may vary, these properties have generally provided attractive returns to investors.

What future prospects of property appreciation do you foresee?

Traditionally, property has been perceived as a favoured , preferred and safe investment option in India. Various factors contribute towards appreciation of property, and future development of the region is a major contributory factor. The development of the region, and especially building of social infrastructure would continue to elevate property prices in Delhi NCR region, especially Gurgaon, making it a great investment option. Prospects of property appreciation are great because infrastructure is getting better, and the best social infrastructure is here. As per recent industry reports, Gurugram’s key locations like New Gurugram, Dwarka Expressway, South of Gurugram have witnessed a price appreciation between 13 percent to 20 percent on year on year basis. Post the recent inauguration of Dwarka Expressway, the price appreciation would reach the next level.

What are your plans for affordable, premium and luxury housing in 2024 and what is in the pipeline for new launches ?

Signature Global is focusing on mid-housing, especially upper-mid-segment housing and continuously evolving with the expectations of the growing middle class. We have a 17 million square feet projects in the pipeline. Furthermore, we have upcoming inventory of 31 million square feet which will be realized over the next 2-3 years. These properties will offer enhanced features, amenities, and a higher level of craftsmanship compared to our affordable offerings. The ticket size for premium properties typically ranges from Rs 1 crore to 5 crore, depending on factors such as size and location.

What are the post poll prospects for real estate in general and Gurgaon real estate in particular?

Generally, the real estate sector tends to be influenced by stability and confidence in the government, as well as policies related to housing, infrastructure development and economic growth. A government that prioritizes infrastructure development, urbanization, and ease of doing business could potentially lead to positive prospects for the real estate sector. For Gurgaon, a major hub for commercial and residential development, its prospects are often tied to broader trends in the national and regional real estate market. Factors such as demand for office spaces, residential properties, infrastructure projects, and regulatory changes specific to the region would shape its post-poll prospects. Gurgaon being a world-renowned city and Asia’s key business centre; would continue to witness growth and development in the times to follow. The real estate sector is bound to see higher appreciation, and we are confident that there would be multifaceted growth in the coming years.

What is the impact of Infrastructural connectivity boost to Gurgaon real estate?

Gurgaon is witnessing continuous development of world-class infrastructure which is making the place well connected to other parts of Delhi NCR and beyond. The recent inauguration of Dwarka Expressway, which is also India’s first elevated urban expressway is an example of government’s focus on continuous development infrastructure and building upon the connectivity of the city. Sector 37D has emerged as a heart of Gurgaon due to its strong connectivity with Dwarka expressway/Northern Peripheral Road, and NH8 through the key Hero-Honda Chowk. Such infrastructure projects make Gurgaon more accessible, reducing the commute time, thus making a huge difference in property appreciation, giving higher returns to investors.

What are your hopes on post -poll full budget for FY 25 and what is your recipe for realty growth?

Our hopes for the FY 25 full budget are centered on policies benefiting the middle class which are crucial for the growth of real estate sector. To boost real estate, focus should be on affordable housing incentives, interest rate reductions, infrastructure development, streamlined approval processes, and regulatory reforms, ensuring inclusive growth and socio-economic development.