Subtotal ₹0.00

Reserve Bank of India (RBI) Governor Sanjay Malhotra has clarified that the proposed relaxation allowing the real estate sector to raise offshore loans through external commercial borrowings (ECBs) will apply strictly to projects compliant with foreign direct investment (FDI) rules, and not for “speculative” activities such as land trading or property flipping.

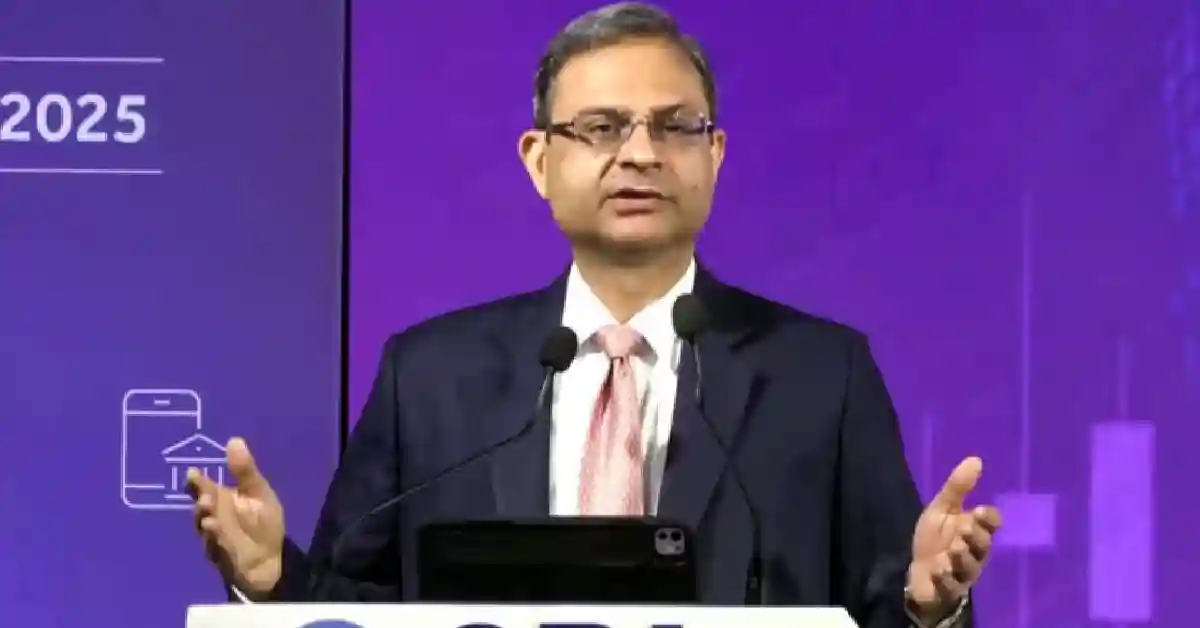

Speaking at the SBI Banking and Economic Conclave, Malhotra also supported the proposal to permit banks to finance mergers and acquisitions (M&As), describing acquisition finance as a vital part of the global banking system that can enhance economic efficiency and expand lending opportunities for Indian banks, according to a report by The Economic Times.

“I wish to clarify that ECB (external commercial borrowing) will be permitted only for FDI-compliant real estate projects and remain prohibited for speculative dealing or loans for land or property trading,” said Malhotra at the SBI Banking and Economic Conclave.

Under the existing ECB rule, such loans cannot be raised for real estate activities.

Relaxation in ECB regulation and allowing banks to finance M&As were among several measures proposed by RBI last month to boost the banking sector as well as the economy.

Finance companies and bond markets already fund acquisitions in India, while worldwide, this is an integral element of an evolved financial system that helps in better allocation of financial resources, Malhotra said. Allowing banks to do acquisition finance “will benefit the real economy” and give banks more business, he said.

The RBI draft on acquisition financing has guardrails like limiting bank funding to 70% of the deal value, caps on the debt-to-equity ratio, aggregate exposure limits relative to tier 1 capital of the bank, and eligibility criteria.